It depends. Whether you must file a federal income tax return depends on whether you are a U.S. citizen or resident alien, your gross income, your filing status, your age, and whether you are a dependent.[i]

You are considered a resident alien for tax purposes if you were a lawful permanent resident of the United States at any time during the calendar year or you meet what is considered the “substantial presence test.” Id.

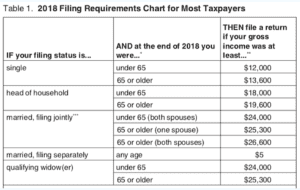

The Internal Review Service (“IRS”) requires U.S. citizens and resident aliens to file a federal income tax return if their gross income, i.e., all income received in the form of money, goods, property, and services that isn’t exempt from tax, for the year was at least the amount shown on the appropriate line in the chart below[ii]:

Generally, a married couple cannot file a joint return if either spouse was a nonresident alien at any time during the tax year.[iii] “However, if one spouse was a nonresident alien or dual-status alien who was married to a U.S. citizen or resident alien at the end of the year, the spouses may choose to file a joint return.”[iv]

Generally, a married couple cannot file a joint return if either spouse was a nonresident alien at any time during the tax year.[iii] “However, if one spouse was a nonresident alien or dual-status alien who was married to a U.S. citizen or resident alien at the end of the year, the spouses may choose to file a joint return.”[iv]

If you have questions about whether you must file a federal tax return for immigration purposes, contact Lally Immigration Services, LLC at (617) 870-1000 or by email to [email protected].

[i] U.S. Tax Guide for Aliens, IRS Pub. 519, Cat. No. 15023T (Feb. 25, 2019), https://www.irs.gov/pub/irs-pdf/p519.pdf

[ii] Dependents, Standard Deduction, and Filing Information, IRS Pub. 501, Cat. No. 15000U (Dec. 31, 2018), https://www.irs.gov/pub/irs-pdf/p501.pdf

[iii] Id.

[iv] Id.